Framework law of 9 July 2004

In Belgium, the framework law of 9 July 2004 introduced the right to a partial refund of special excise duties on professional diesel of up to more than €190/m³!

Eligibility conditions and legal obligations:

- Any Belgian or European business that uses eligible vehicles (lorries, coaches, buses, taxis) on behalf of themselves or third parties,

- Diesel refuelling at public or private stations on Belgian territory,

- Maintenance of specific accounts, accurate monthly returns, keeping compliant supporting documents.

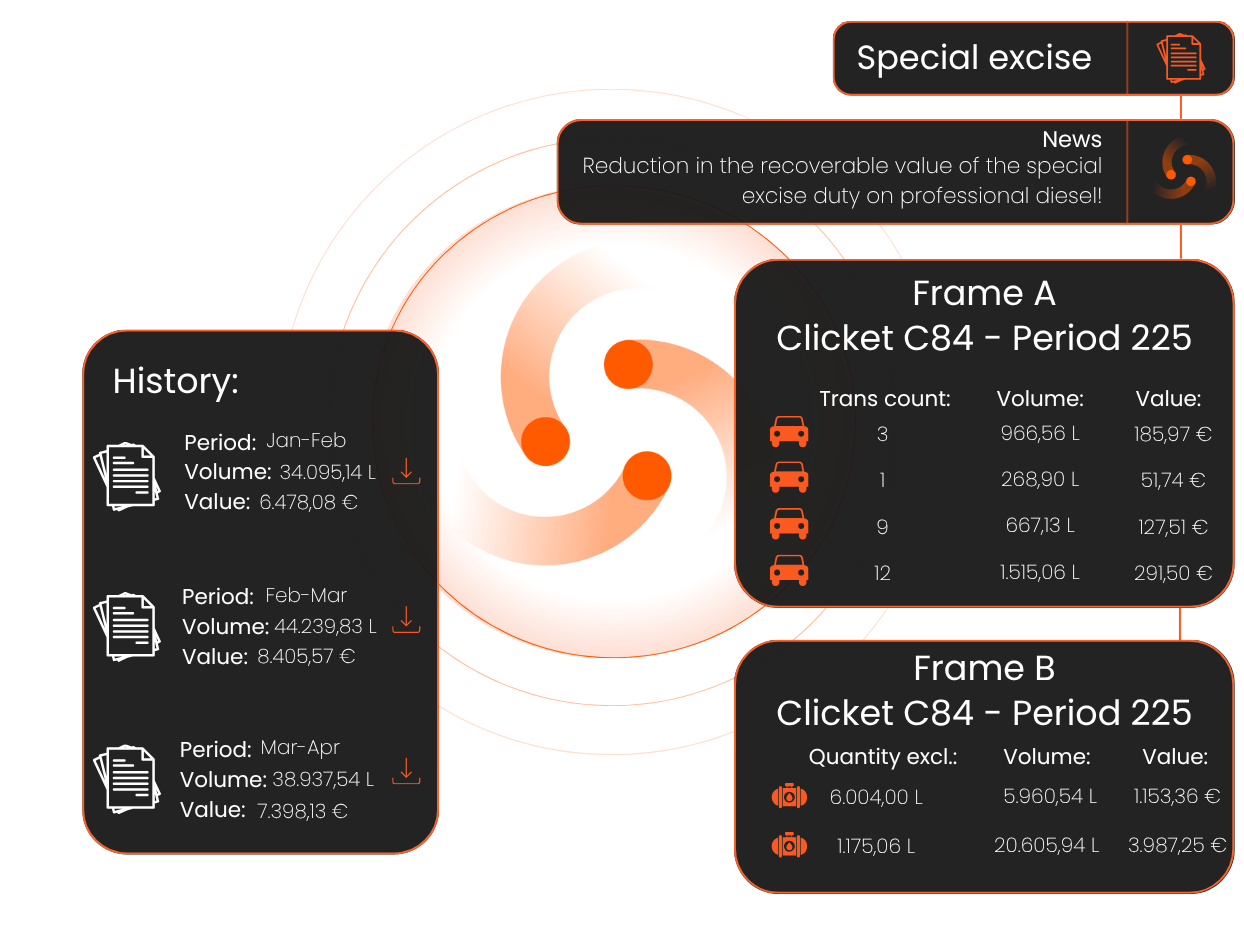

The enerdrive sphere automates all of these operations: it collects the data, calculates the total amounts that can be refunded and generates claims, helping you save time and ensure compliance.

Automated and compliant accounting methods

Automated calculations and generation

Approved accounting methods

Specific accounting processes are completed in the background

Managing the special excise duty demands complicated accounting procedures and accurate monthly claims, without which you could lose significant amounts of money. With the Special excise duty module from the enerdrive sphere and with all the centralised data, these calculations are carried out automatically, without the need for any manual intervention: in just two or three clicks, you can generate your ad hoc documents.

However you refuel (at private or public gas stations), our solution incorporates the legal rules and applicable thresholds to guarantee you:

-

streamlined, optimised claims,

-

compliance with accounting obligations,

-

significant time saving across all of the processes.

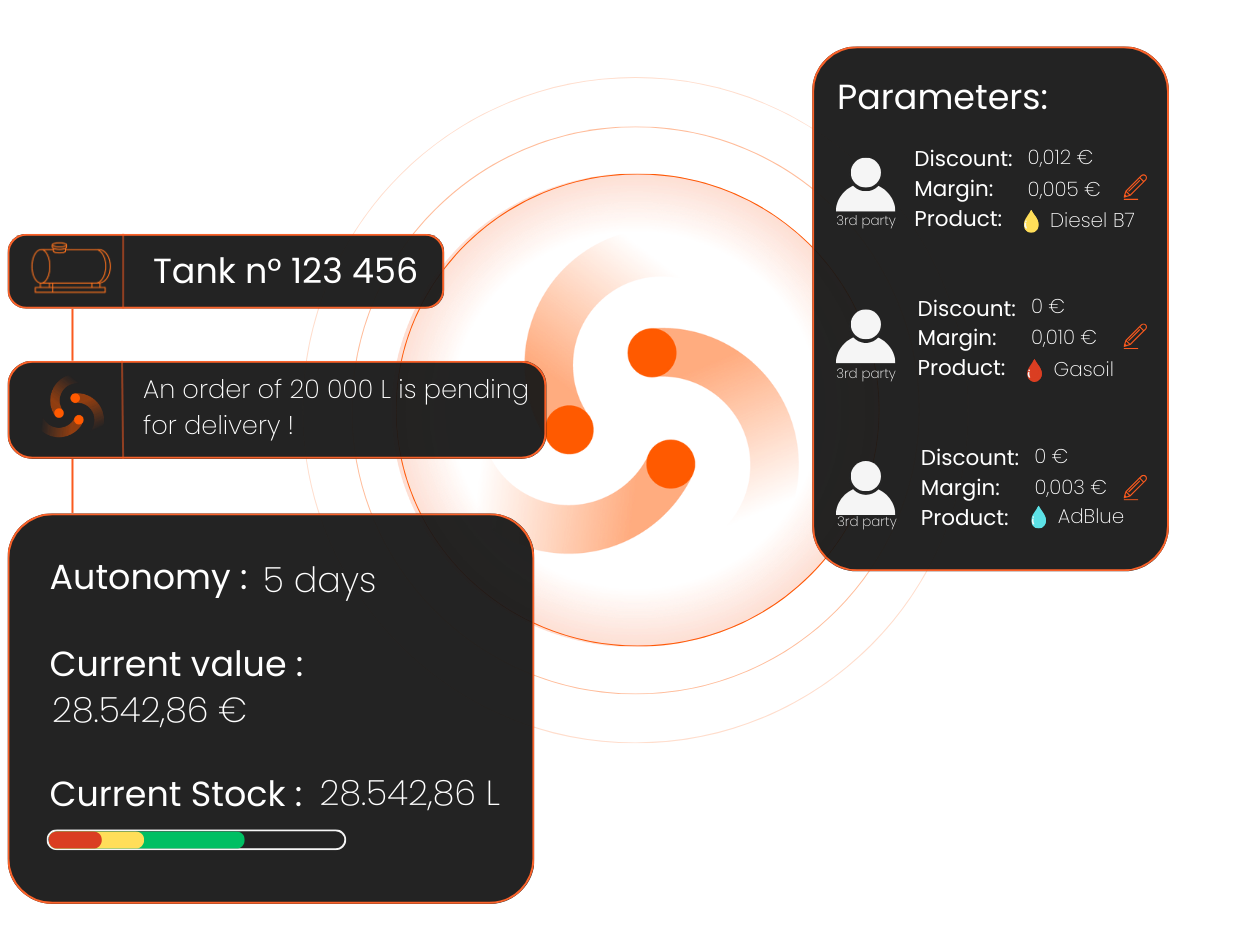

Sharing your private fueling station is so simple

The billing procedure for third-party refuelling couldn’t be more straightforward

To develop your partnerships or pool costs, offer access to your station to subsidiaries or third parties, without any complicated admin.

Thanks to the enerdrive sphere, data collection, billing calculations and the generation of detailed breakdowns are automated. In just a few clicks, you can generate:

-

total costs for regular refuelling at a specific rate,

-

detailed breakdowns for each third party,

to save time and secure any sharing of your infrastructure.

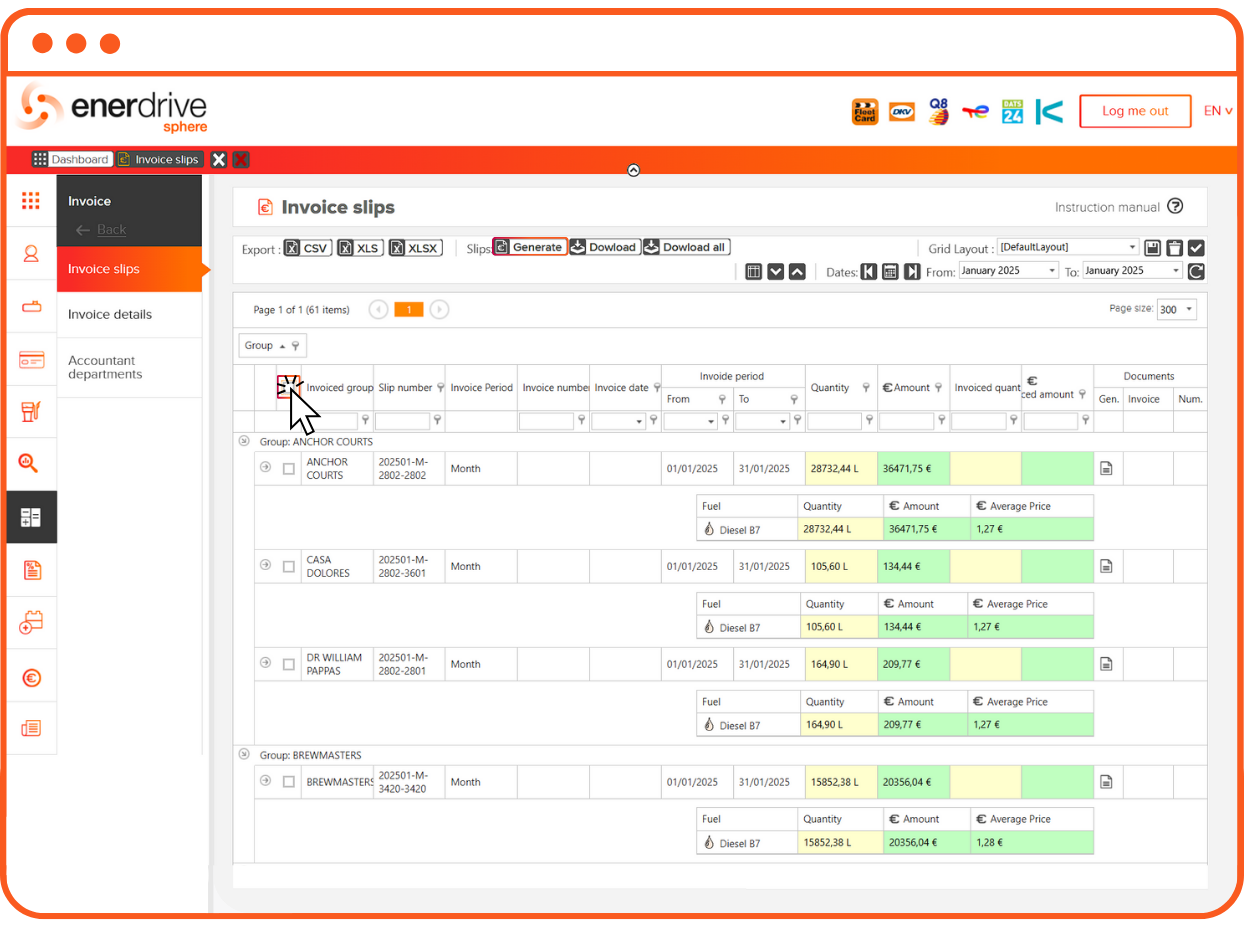

Automatic generation of detailed breakdowns for each third party

Calculations using sale prices

Managing cost prices and margins

Detailed breakdowns, with prices assigned in 2 clicks

The cost of every refuel is automatically calculated according to whatever margin you set for each third party.

In the Billing module of the enerdrive sphere, in just two clicks you can generate all of your detailed breakdowns, calculated at the correct value and ready to be sent with your bills.

Frequently Asked Questions

Is my company eligible to reclaim Belgian special excise duty on Professional Diesel?

Any Belgian company – or any company based in a member country of the European Union – can claim back some special excise duties on Professional Diesel if it uses certain types of vehicles subject to the duty on its own behalf or on behalf of third parties (lorries, coaches, buses, taxis etc.).

-

Filling up in Belgium: this must be done at a public or private station on Belgian soil.

-

Significant amounts: the rate of excise duty is more than €190/m³, making this a significant financial claim.

-

Bespoke analysis: if you have any doubts about your eligibility, our experts will look into your situation and help you optimise your excise duty claim.

With the enerdrive sphere, you will benefit from an automated process and expert support to reclaim what you are owed.

I don’t fully understand the rules around reclaiming special excise duty on Professional Diesel. Can you help?

Of course! The Belgian rules about Professional Diesel are complicated and change on a regular basis. That is why, as a customer of the enerdrive sphere, Tele-Naro offers you:

-

Specialist support: our experts guide you through the process step by step to help you understand your obligations and establish best practices.

-

Dedicated training: tailored sessions to understand the procedures involved in reclaiming special excise duty and avoid administrative errors.

-

Ongoing support: Tele-Naro updates your enerdrive sphere as regulatory changes are frequently introduced.

With Tele-Naro, you always have our support so can enjoy complete peace of mind.

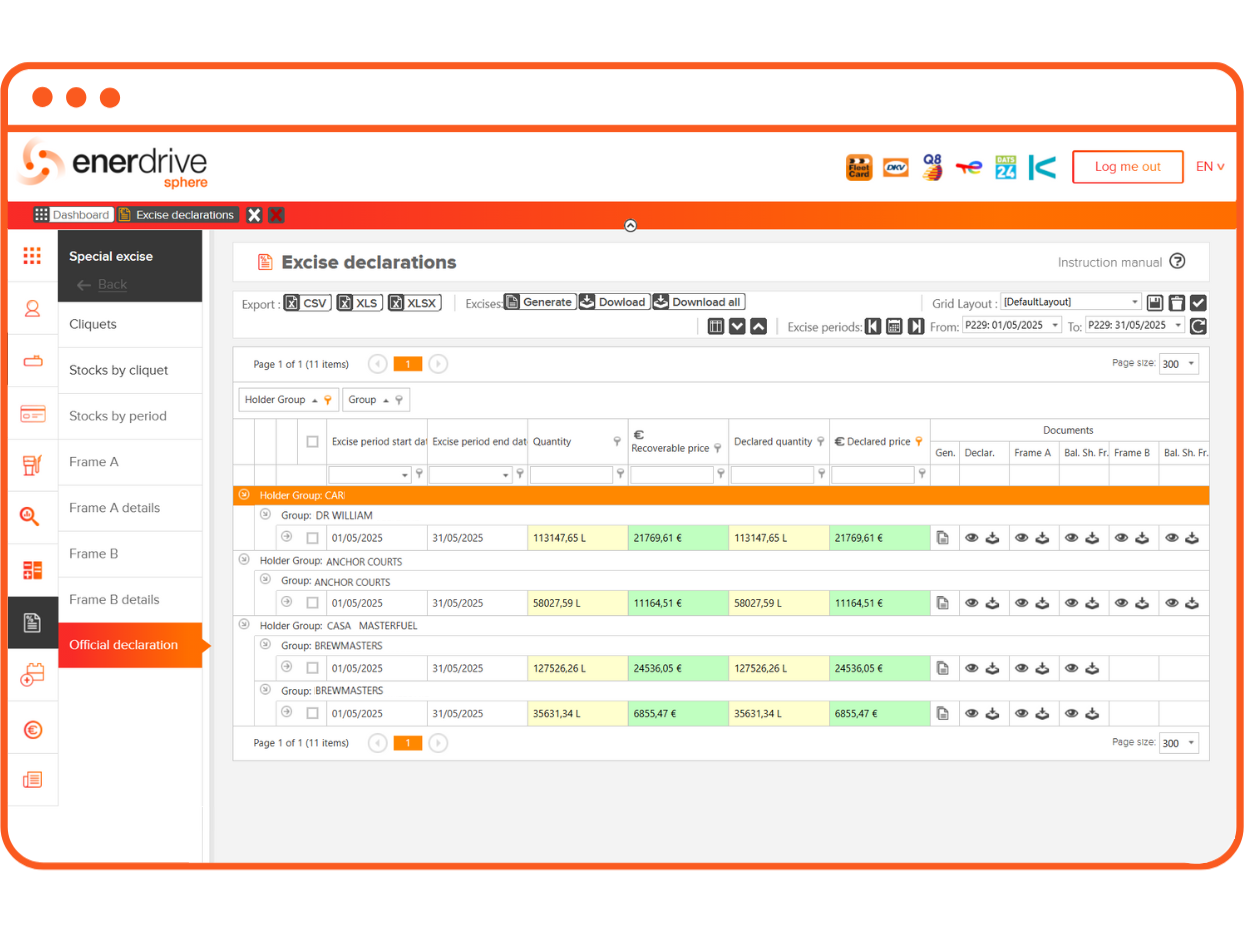

Do your methods for calculating refund claims for special excise duty on Professional Diesel comply with Belgian regulations?

Yes, the accounting methods integrated in the enerdrive sphere have been approved by Belgium’s Customs and Excise authorities.

This guarantees that your A and B schedules are calculated in accordance with regulatory requirements to offer you optimised refund claims for what you are owed.

Can I adjust my margin on transactions by third parties at my private gas station?

Absolutely, yes. The Discounts and margins module of the enerdrive sphere offer you complete flexibility:

-

Customised pricing policy

Define specific margins for each product and for each third party, based on your commercial agreements. You can even set each transaction at your actual cost price. -

Personalised billing periods

Set the billing frequency for each third party: weekly, fortnightly or monthly. -

Generate breakdowns instantly

In a matter of clicks you can create detailed breakdowns for each period and each third party, automatically calculated according to the values and conditions that you have defined.

So you can keep accurate control of your margins and bill multiple companies easily, without any tricky admin.

Do you have any questions about the enerdrive sphere?

We want to know what each and every one of our customers has to say and look forward to forging a close relationship with you.